When it’s time to dissolve your New York limited liability company, you want it done right and with no loose ends left behind. With a clear roadmap of how to get this done and the aid of an NY LLC Lawyer, you won’t have to worry about missing important steps.

We provide comprehensive guidance for LLC owners who are considering dissolving their LLCs in New York.

Understanding the Dissolution Process for NY LLCs

A variety of factors can lead to the dissolution of an LLC in New York. These factors include internal disputes and conflicts between partners. Relocation to another jurisdiction and mergers can also lead to the dissolution of a New York LLC.

Regardless of the reason, it is crucial to have a clear understanding of the dissolution process to help ensure it goes off without a hitch. We will explore the legal aspects and considerations that come into play during this process.

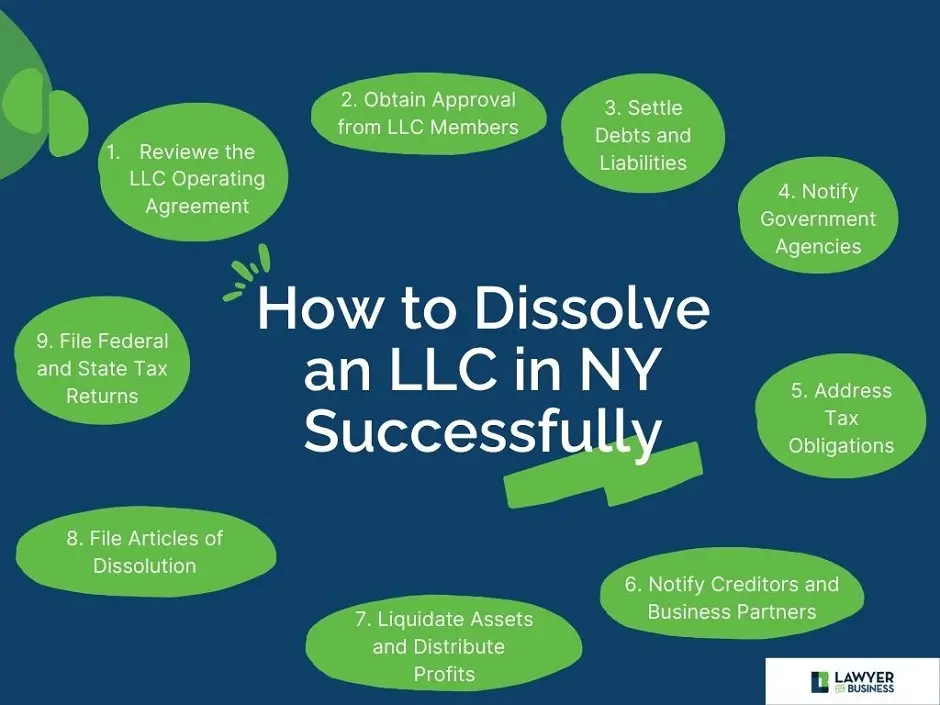

Step-by-Step Guide to Dissolve an LLC in NY

This step-by-step guide lays out the dissolution process in a clear and actionable fashion. Each stage is explained in detail, leaving you with clear instructions on how to proceed confidently through the process.

Step 1: Reviewing the LLC Operating Agreement

Before you begin the dissolution process, it is important to conduct a thorough review of your LLC’s operating agreement. Doing so will ensure you remain in compliance with any dissolution terms found therein.

It will also help set the groundwork for a smooth dissolution process that can easily become rocky without an understanding of relevant dissolution provisions found in the operating agreement of your LLC.

Step 2: Obtain Approval from LLC Members

One of the main requirements for dissolving an LLC in New York is the consent of all members of the LLC to do so. In many cases, getting this consent may be quite easy, while in others, there may be dissent or concerns with the dissolution.

Whatever the reason, open and clear communication is necessary for the dissolution to continue without major issues and to receive unanimous approval for the action. The action should be documented in a Resolution drafted by your attorney which complies with NY law.

Step 3: Settle Debts and Liabilities

The debts and liabilities incurred by your LLC must be addressed and dealt with if you want the dissolution process to run smoothly. Completing this step requires an in-depth assessment of the LLC’s liabilities, assets, balance sheets, and other considerations.

It is important that every financial obligation, from loan debts to outstanding account balances, is fulfilled in order to protect the members of the LLC from future liabilities.

Step 4: Notify Necessary Government Agencies

A key step in the dissolution process is to notify the relevant government agencies, such as the New York Department of State, about the LLC’s dissolution. The notification process will require you to inform relevant agencies of your intention to file articles of dissolution.

Failure to properly notify the appropriate government agencies about the dissolution of your LLC can potentially lead to fines and penalties.

Step 5: Address Tax Obligations

LLCs have tax obligations with the state and federal government that must be adequately resolved before the LLC can be dissolved. You must file the LLC’s final business tax returns before the dissolution will be complete, and you should also obtain a tax clearance from the New York Department of Taxation if you have employees.

With your tax issues settled, you’ll have no worries about future liabilities, and your dissolution process will run more smoothly.

Step 6: Notify Creditors and Business Partners

LLC dissolution cannot continue unless you clear outstanding obligations with creditors and any business partners the LLC has made along the way. Clear communication is important at this juncture, as are due diligence and good faith in satisfying any outstanding financial obligations.

It’s important to maintain the good relationships your LLC has forged and avoid complications and potential liabilities when you conduct business in the future.

Step 7: Liquidate Assets and Distribute Remaining Profits

Once the LLC’s financial obligations have been met, it will be time to liquidate the LLC’s assets and distribute the proceeds and remaining profits among LLC members. The process of distributing LLC assets will take place according to the operating agreement of the LLC and state law.

Transparency is of utmost importance during this stage. The accountancy should be conducted diligently and in good faith according to best accountancy practices.

Step 8: File Articles of Dissolution to Officially Close the LLC with the State

Filing Articles of Dissolution with the appropriate state authorities is the step that officially terminates the LLC in New York.

The form you file will need to include:

- The business name of the LLC;

- The date the LLC was organized;

- A written consent form;

- The reason for choosing to dissolve the LLC.

When entering this final step, it is important to abide by all filing requirements and legal rules to avoid unnecessary delays and costs and to ensure member confidence moving forward. You should not prepare or file this form on your own without assistance from a skilled business attorney or you could make costly mistakes.

Step 9: File Final Federal and State Tax Returns

The final step in dissolving an LLC is filing the LLC’s final federal and state tax returns, including final sales tax returns. Doing so keeps LLC members in compliance with government tax obligations and keeps them from future issues that may arise.

Additionally, these federal and state tax returns should be filed in a timely manner, or potential complications could surface later down the line.

Reasons for Dissolving an LLC in NY

There are various reasons why members would decide to dissolve an LLC. When they do, they are not only opening the door to challenges but also opportunities. Shutting down any business is a challenge. But along with closing a chapter comes opportunities for future business ventures.

Some reasons why LLCs are dissolved in New York include:

- The business venture has concluded, or the business has run its course;

- Poor management and leadership;

- Internal disputes and conflicts between members;

- Business relocation to another jurisdiction;

- Business merger;

- Accountancy and cash-flow problems.

Understanding these common reasons for closure can give valuable insight to those contemplating dissolving their LLC.

Professional Support for Dissolving Your NY LLC: Contact Lawyer For Business Now!

When it comes time to dissolve an LLC, you must follow certain steps to the letter to avoid future issues. From initial discussions with members to satisfying debts and distributing profits, you can help ensure a smooth process by enlisting an experienced attorney.

Lawyer For Business can guide you through every stage with quality legal services and support. Contact us for a consultation and find out how we can help you during this journey.